The right tech stack means the difference between agility and overload. Manufacturers who can discern essential, scalable solutions will see greater cost efficiency and success with AI.

Amid mounting supply chain pressures, CPG brands are expected to continue reducing costs and optimizing operations, but the sheer number of automation and efficiency solutions being proposed to them can become overwhelming. Beyond the baseline price tag, the wrong data stack can absorb time, energy, and resources, pulling focus away from strategy and execution. Facing greater competition and heightened retailer expectations (including for cross-channel optimization), suppliers must equip themselves with the right tools to stay ahead.

An ideal CPG technology stack should act as an engine, driving efficiencies across the end-to-end supply chain; as an information hub, enabling real-time insights for fast, accurate decision-making; and serve as a scalable foundation that can seamlessly adapt to evolving demands.

Just like making a packaging change from heavy glass bottles to lightweight aluminum can cut production costs and increase shelf efficiency, choosing the right technology mix can drastically reduce time-to-insight and accelerate outcomes. Here’s Crisp’s essential guide to CPG technology essentials that deliver.

EDI today

A time-tested system, EDI formats and operating models remain deeply ingrained in the business systems of major retailers, which is why the technology is often still required for suppliers. Far from outdated, EDI remains an indispensable solution, offering real-time visibility into orders, change orders, payments, and more. Historically a siloed function of supply chain and logistics teams, EDI data can now integrate with ERP and analytics tools, providing a clear view of daily business exchanges across teams.

Far from outdated, EDI remains an indispensable solution, offering real-time visibility into orders, change orders, payments, and more.

Beyond internal applications, EDI crucially informs third-party logistics (3PL) providers, and can also benefit CPG sales agencies — who manage retail accounts and broker transactions on behalf of manufacturers. EDI sharing through tools like WinRep supports sales broker order tracking, along with commission set-up, tracking, and reconciliation for multiple brands across multiple retailers.

Harnessing real-time EDI records and integrating them with your technology stack sets the foundation for improved order visibility, supply chain agility, and more efficient company-wide decision-making.

Making ‘big data’ digestible

Beyond EDI, modern CPG suppliers have access to a vast array of data sources, from point-of-sale (POS) sales and inventory data made available by retailers, and direct-to-consumer (D2C) sales data, to syndicated market reports, marketing performance insights, external intelligence like weather, and more. While these resources are invaluable, manually consolidating them into systems can lead to unstructured data overload, hindering rather than empowering analysis and decision-making.

In order to successfully integrate these varied data sources into a streamlined format for teams to access, query, analyze, and act on, data can be automatically rather than manually ingested, then normalized, structured, and reliably delivered into systems like cloud platforms and BI tools. Some of the solutions commonly employed by teams to accomplish this include:

- Extract, transform, and load (ETL): Platforms like Fivetran, Airbyte, and RudderStack automate the ingestion and movement of raw data from disparate sources into a chosen destination without the need for manual downloads.

- Data modeling and transformation: Data build tool (dbt) and SQLMesh take the next step, transforming and modeling data into standardized formats that align with organizational needs.

- Data pipeline scheduling and orchestration: Paired with orchestration tools like Dagster and Airflow, which schedule and automate data pipelines, these systems ensure that clean insights are delivered to decision-makers efficiently and reliably.

- Data observability: Tools like BigEye, Elementary, and Monte Carlo provide real-time monitoring and alerting for data quality issues, ensuring data reliability and integrity across the pipeline.

- Data governance: Solutions such as Dataplex, Collibra, and Azure Purview help organizations establish and maintain data policies, access controls, and compliance standards.

Crisp accomplishes these processes and more with an open-data platform that is purpose-built for the retail industry. Crisp automatically ingests, normalizes, and streamlines data from leading retailers and distributors, eliminating manual portal extractions and streamlining intelligence across complex, disparate accounts.

Further, Crisp’s master data management (MDM) tool and customizable and extensible semantic layer technology enable CPG teams to customize product attribution, including product names, categories, sub-categories, and more, for consistent reporting across accounts. Before being delivered into native analytics tools and the systems teams leverage.

While data resources are invaluable, manually consolidating them into systems can lead to unstructured data overload, hindering rather than empowering analysis and decision-making.

Centralize to scale

As CPG brands expand their portfolios, retail partnerships, and omnichannel presence, the ability to centralize data becomes paramount. Fragmented systems and siloed insights can lead to inefficiencies, missed opportunities, and an inability to respond to shifting retailer and consumer demands. By adopting a centralized approach to data, brands gain a comprehensive, unified view that empowers cross-functional teams and scales seamlessly alongside business growth.

Two data storage destinations that can be leveraged in the CPG tech stack are cloud environments and business intelligence (BI) tools.

- Cloud platforms: Cloud platforms like Snowflake and Databricks provide CPG brands with the flexibility and scalability needed to manage growing data ecosystems. These platforms allow businesses to ingest and harmonize diverse datasets – such as omnichannel point-of-sale (POS) inventory and sales data, syndicated data, marketing performance data, and more – into centralized environments for consistency, security, and accessibility across the enterprise.

For example, when D2C darling Ritual Vitamins expanded into brick-and-mortar retail, the team leveraged Crisp for fast, seamless integration of real-time Target and Whole Foods data into their Snowflake instance, eliminating the need for costly pipeline building and ongoing maintenance.

By adopting a centralized approach to data, brands gain a comprehensive, unified view that empowers cross-functional teams and scales seamlessly alongside business growth.

- Business Intelligence (BI) tools: BI platforms like Power BI and Looker transform centralized data into actionable insights, helping teams visualize trends, monitor performance, and collaborate more effectively.

For example, PopSockets uses Microsoft Power BI in combination with Crisp and Snowflake to create custom store cluster reports for inventory allocation and replenishment strategies. These reports include insights such as the performance of products displayed behind locked glass panels at Walmart locations, enabling data-driven adjustments to maximize sales.

Similarly, Ritual Vitamins leverages Google’s Looker for a unified orders report that combines in-store retail sales with Amazon and D2C sales, enabling a holistic view of performance across channels to optimize operations and inventory allocation.

Need-to-have analytics

Regarding daily analysis and decision-making, retail analytics are essential for CPGs navigating nationwide distribution and a competitive omnichannel landscape. From managing inventory to maximizing promotional effectiveness, robust analytics ensure teams can respond to retailer and consumer demands quickly and precisely.

Regarding daily analysis and decision-making, retail analytics are essential for CPGs navigating nationwide distribution and a competitive omnichannel landscape.

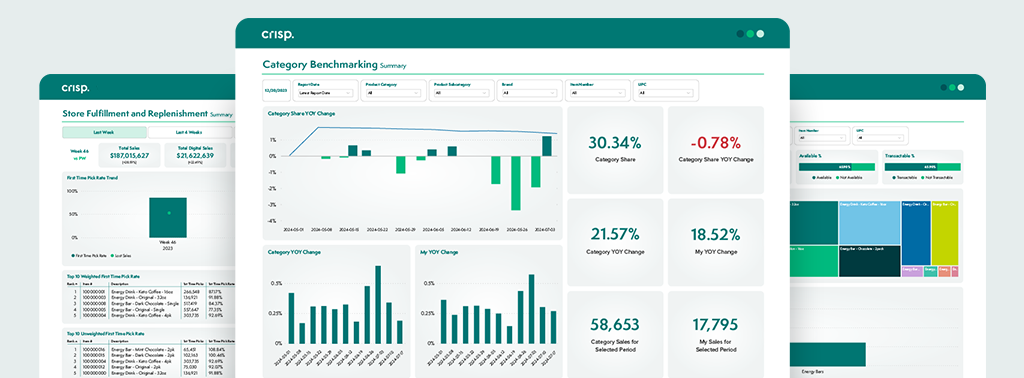

- Crisp Retail Analytics (CRA): Crisp Retail Analytics (CRA) provides daily actionable insights for CPGs, seamlessly integrating data from top retailers, including Target and Walmart, into interactive dashboards and customizable reports. Built on Power BI, CRA enables suppliers to track sales and inventory down to the individual SKU and store-level, along with a host of other key performance reports made available by retailers to optimize supplier performance. Crisp’s Target solution features pre-built and customized report capabilities around 5,000 Target-defined metrics that mirror KPIs valued by buyers internally.

Similarly, CRA for Walmart provides omnichannel performance insights across in-store, online, and pickup channels, along with visibility into supply chain diagnostics, OTIF performance, and digital transactability, enabling Walmart suppliers to fine-tune strategies and improve both online and in-store shelf availability.

CRA further harmonizes granular sales and inventory insights across 30 additional retailers, including Amazon, Whole Foods, Wegmans and more.

- UNFI Insights: Powered by Crisp, the UNFI Insights platform empowers suppliers with comprehensive sales, inventory, and category-level data across natural and conventional channels. Suppliers can access Monday morning snapshots of key metrics, dive into granular store- and product-level insights, and track inventory nearing expiration to minimize waste. For example, read how Nestlé USA streamlined UNFI reporting across 1,500 SKUs, or how fast-growing Chosen Foods eliminated waste in their UNFI supply chain by leveraging daily Crisp insights.

Shelf-savers to keep product moving

Effective trade promotion and inventory management are critical for CPGs, especially for products with limited shelf life or those requiring precise stock control. With the right tools, brands can avoid waste, ensure optimal stock levels, and maximize the impact of promotional strategies – key factors in maintaining profitability and competitiveness.

- Optimize trade promotions: Promotional effectiveness is critical to staying competitive in retail, but poorly executed trade spend can erode profitability. Solutions like Promomash empower brands to plan, implement, and measure promotions with precision. Through real-time integrations with Crisp, Promomash ties point-of-sale (POS) and shipment data directly into trade performance dashboards, allowing teams to see promotion ROI down to the SKU and store level.

- Real-time inventory management: Out-of-stocks and overstocks can both spell trouble for CPGs. Crisp’s inventory insights provide visibility across distribution centers and individual stores, enabling supply chain teams to proactively adjust stock levels.

With the right tools, brands can avoid waste, ensure optimal stock levels, and maximize the impact of promotional strategies — key factors in maintaining profitability and competitiveness.

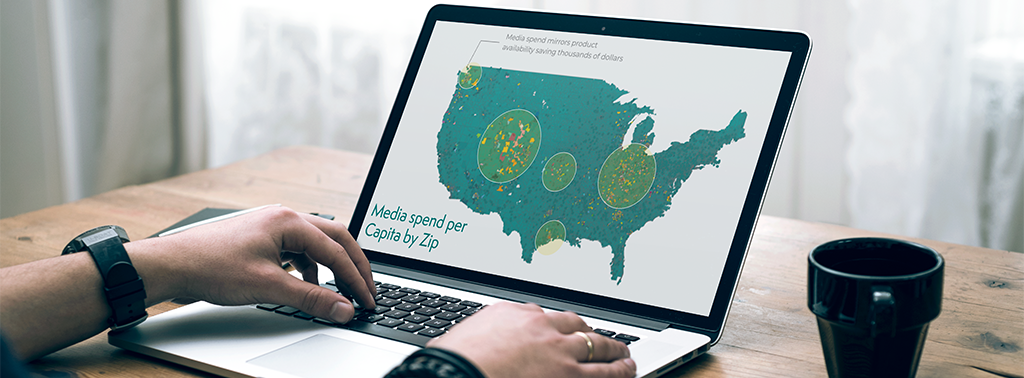

- Bridging digital advertising and in-store sales: The rise of omnichannel retail has made it essential for brands to understand how digital campaigns influence in-store sales. Crisp’s collaboration with media agency partners like Tinuiti has revolutionized this capability. By linking Crisp’s granular retail data with Tinuiti’s advanced media analytics, brands like poppi have unlocked a direct connection between online advertising and brick-and-mortar performance (how poppi linked TikTok campaigns to an 80% in-store sales increase).

Advanced data science and AI Blueprints

With the right data foundation, AI’s rapidly evolving capabilities unlock new levels of precision in retail analytics, from daily decision-making to automated machine learning (ML) models and more profound revelatory data science.

- Out-of-the-box ML with Crisp AI Blueprints: Pre-built and customizable machine learning models, commonly distributed as Jupyter Notebooks, can be integrated into Databricks and Google Colab environments to unlock fast, deeper analytics and fuel innovation. Crisp’s AI Blueprints for the retail industry span store clustering, weather analytics, anomaly detection templates, and more to help customers efficiently integrate Crisp into their existing workflow and set the foundation for future applications.

Crisp’s AI Blueprints for the retail industry span store clustering, weather analytics, anomaly detection templates, and more to help customers efficiently integrate Crisp into their existing workflow and set the foundation for further applications.

- Semantic layer is the key: A semantic layer is essential to create a unified framework for disparate retailer and distributor data sources. By standardizing metrics, relationships, and business logic, a semantic layer transforms raw data into a consistent, business-friendly language that is accessible to technical and non-technical teams alike. This scalable foundation supports clean, accurate data flows and ensures readiness for AI use cases, enabling algorithms to deliver actionable insights that fragmented pipelines (costing up to $500K annually to maintain) cannot support.

- Natural language query interfaces: Imagine not just asking questions like, “What were the regional drivers of our seasonal assortment performance?” figuratively, in querying data, but literally, using conversational language to interact with your data analytics system. By leveraging large language models (LLMs) connected to structured real-time and historical data, these interfaces deliver business-friendly responses that fuel curiosity and accelerate decision-making for any team.

To implement these tools effectively, organizations can look to enterprise-grade solutions like Snowflake Cortex or Databricks Genie, designed for scale and equipped to process the vast breadth of data CPGs manage.

Extras: what’s out

As CPG technology evolves, legacy approaches struggle to meet modern commerce demands. Syndicated market reports, while historically valuable, now lag behind in timeliness and granularity. By the time these reports are published, critical opportunities for inventory and promotional adjustments have often passed, making daily point-of-sale (POS) data a critical resource.

What’s undoubtedly out for 2025 are disparate retail data solutions, like combining manual portal reliance with slow reporting processes to extract meaningful insights. Disconnected data tools trap insights in isolated pockets.

Finally, data visualization tools for individual retailers — without robust backend integration — fail to address the deeper complexities of brand operations. CPGs now require seamless pipelines that streamline multiple retail data sources and flow directly into platforms for fast, reliable, and scalable analytics and execution.

By eliminating the inefficiencies of manual or ad-hoc reporting tools, CPG companies can reallocate time and resources toward strategy, innovation, and growth opportunities, critical for staying ahead in modern retail.

Find the tech stack that’s right for you, consult with Crisp by booking a demo.