SunButter’s sales team uses Crisp to anticipate demand and prevent out-of-stocks, distributing nationwide just in time for an allergy-friendly back-to-school season.

Sunflowers get a new assignment

SunButter® is a perfect example of things coming together in the right place at the right time. It all started in Fargo, North Dakota, home to a booming sunflower industry. When exports began to decline in the 1990’s, producers like Red River Commodities started to think of other ways to use their versatile, sustainable crop. At just the same time, the USDA was looking for peanut-butter alternatives in schools, noting the rising allergies among school-age kids. So the chemistry department at Red River got to work, and the product they developed passed with flying colors. Enter SunButter: a nut butter alternative that’s free of common allergens while also boasting great sunflower flavor with more vitamins and minerals.

SunButter started as a school lunch solution, not a retail brand – but after bottling their first jar in 2003, the governor held it up on TV and said, “This is the future of North Dakota.” From there, SunButter was off to the races: the jars got picked up in local grocery stores, and spread across the midwest as retailers noticed strong sales and growing demand. When now Managing Director Justin LaGosh came on in 2008, SunButter was in just a few hundred retail stores. Fast forward to today, and they’re in 26,000 retail locations in addition to schools nationwide.

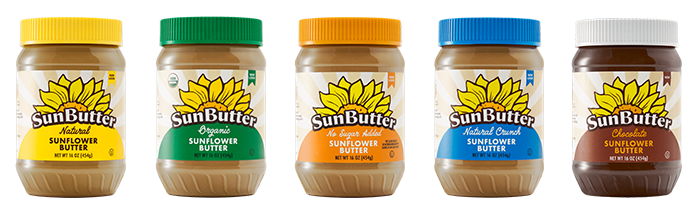

With distribution everywhere the sun shines, Justin’s team now focuses on growth through same-store sales and adding additional SKUs (chocolate SunButter, anyone?). In the last two years, they’ve attracted new buyers to the category by focusing on their product’s taste and nutritional benefits ahead of its allergy-friendliness. This has helped SunButter protect unit growth despite today’s inflationary pressures.

A masterclass in supply chain

Of course, in order to drive those same-store sales, the products need to get to the stores. And as a small-to-medium sized business that goes through distributors, the last few years have been an advanced course in supply chain management. As Justin explains, “We thought keeping up with sales during a pandemic buying was tough…but what’s more difficult is keeping distributors stocked amidst labor shortages, supply chain challenges, and the rising cost of carrying inventory and logistics.”

To meet the challenge, SunButter’s sales team works to anticipate demand and monitor their supply chain. But that turned Justin’s leadership position into hours spent poring through pivot tables and spreadsheets from multiple retailer and distributor portals. With limited time on his hands, he had to prioritize compiling data for just his top accounts, leaving other opportunities on the table.

That just wouldn’t work for back-to-school season, where SunButter sees 40% or more of their annual sales. “How do you pinpoint problems, lead your salesforce to the right areas, and ask the right questions about supply chain operations without a tool to analyze data?” he asked. Originally, SunButter tried building their own data lake and a model for detecting retailer voids, but the issues of exporting data, adjusting naming conventions, and re-uploading spreadsheets, over and over again, were still keeping the team from taking action. That’s when he turned to Crisp.

“We thought keeping up with sales during a pandemic buying was tough…but what’s more difficult is keeping distributors stocked amidst labor shortages, supply chain challenges, and the rising cost of carrying inventory and logistics.” — Justin LaGosh, Managing Director

Solving the sales equation

Now, SunButter’s sales team uses Crisp on a daily basis to keep distributors and retailers in full supply. The first step is anticipating demand, so Justin’s team analyzes sell-in and sell-through data to project sales, making a data-driven case for higher order volumes where needed. “When we tell a buyer they’re not ordering enough, it’s easy to sound like we’re just salespeople trying to sell more,” Justin explains. “But when you can say that register sales are growing at 15% and you’ve only ordered 8% more than a year ago, and you’re going to miss sales, that’s much more believable.” This is also helpful to buyers, who manage hundreds of products and don’t have time to forecast demand for each brand and SKU. Data helps SunButter make sure that retail partners aren’t missing those opportunities.

Justin’s team also tracks sales performance to see what’s going well and find opportunities to improve. Viewing sales and distribution dashboards by geography, he can identify what higher-volume stores are doing that can be applied to other locations. For instance, Justin might see that one of his top five retailers has gained sales since buying SunButter’s newest chocolate SKU. This creates a powerful sales story he can use in buyer conversations. Justin also monitors velocity data across regions and chains to make sure marketing dollars and promotions are driving meaningful lift. “If I’m going to spend marketing dollars, I want to drive sales where they’re growing already, and Crisp allows me to do that,” he explains.

Thanks to Crisp’s dashboards, Justin can focus on sales leadership, and count on his team to monitor their own accounts: “I push the whole sales team to use Crisp,” he says. “Now, I expect them to come to me and say, ‘here’s what I found, and here’s what I did about it.’” Justin also filters dashboards by chain to keep track of each salesperson’s accounts as well as his broker teams.

“If I’m going to spend marketing dollars, I want to drive sales where they’re growing already, and Crisp allows me to do that.” — Justin LaGosh, Managing Director

Never late for class

With orders flowing in, Justin’s other strategy is to detect and resolve out of stocks and voids as quickly as possible. He uses Crisp’s Voids and Inventory dashboards to problem-solve. “With Crisp, I can start at a high level, but then I can identify a problem, dig in, and lead down a path to get to actionable insights,” he says. Using Crisp to improve distributor fill rates and communicating earlier about inventory lags, Justin estimates that SunButter has saved $250K in avoided stock-outs in the past year alone.

When it comes to supply chain operations, time is of the essence. Crisp’s dashboards have saved Justin 10 hours per month, condensing 2-3 hours of problem-solving in spreadsheets into less than 30 minutes whenever issues arise. As a result, more timely communication with buyers leads to real wins. For instance, Justin was talking with one retailer who thought that their stores’ out-of-stocks were due to a supplier short. Using Crisp, Justin was able to quickly track orders and shipments through his distributor, call his facility, and show that the order was in fact filled, but hadn’t actually been picked up by the buyer. Ultimately, this level of transparency leads to better in-stock rates and a stronger partnership with retailers.

With their supply chain humming along, SunButter can look ahead to a bright future. Their newest chocolate SunButter flavor, which boasts 80% less sugar than the competition, is quickly rising to become one of their most popular. The team is also working on entering an entirely new category, which they’ll share more about in the coming months.

To learn how Crisp data can power your brand, contact us for a demo. For more inspiring stories and data best practices, subscribe to the blog.