For small and medium-sized food producers, POS is the holy grail of metrics. After all, no sales — no business. But what are you missing when all your analysis time is spent diving into POS numbers?

Here, we reveal what other data deserves a seat at the table to not only help your CPG brand grow, but also streamline operations, maintain profitability, and avoid common setbacks.

POS: One part of the puzzle

It makes sense that time-strapped food producers spend much of their data analysis efforts on POS data. It offers the best means to assess the health and success of your product at retail, and every key stakeholder in your business wants to know how many units you sell per week. POS data can also give you a glimpse into how your marketing campaigns are performing and give clues that can help with production planning.

POS data is far more useful, though, when you combine it with other information to get a fuller sense of your business. “POS certainly doesn’t give you a full understanding of inventory planning and production planning, especially with shorter shelf life products,” says David Koretz, a food industry entrepreneur and founder with experience in fresh, frozen, and shelf-stable products. “It’s only one part of the puzzle.”

Other key metrics to track

So what data can you use to get that broader view? Here are three categories that will help you plan your production, take advantage of market opportunities, prevent waste, keep your customers safe, and stay in compliance with government regulations. And in the end, all of this data ties into sales as well.

Distribution data

You may have a handle on your sales volume, but understanding your current and potential distribution is the key to smart growth. An important figure to know is all-commodity volume (ACV). This number shows you the relative strength of different retailers in your distribution network as a percent of overall sales in the market, so you can focus on gaining entry or expanding shelf space in stores with the highest potential for revenue.

Once you have a sense of opportunity areas, you want to think about where your product in particular has potential to succeed. If not, you may grow into stores that aren’t a strong fit and hurt your overall velocity numbers. For example, if there are more than 400 Stop & Shop stores in the Northeast and you’re only selling to 40 of them through your distributor, it seems like there is more opportunity to be had — but you can dig in further to identify quality growth opportunities. A next step is to drill down into different geographical zones, and look into your product’s performance with other nearby retailers. If a certain zone is performing well for your snack brand — say, a college town — you can predict that other stores in the same zone, or even other college towns, will do well too. When you take this to your next buyer meeting, you can make an educated case for expanding to new stores, backing this up with sales data showing that the product has sold well in comparable or nearby locations.

Safety data

Managing food safety is a must for food producers: not only are food safety issues a danger to consumers, but product recalls can cost millions of dollars and hurt brand reputation.

Keeping food safe requires robust data tracking and analysis practices. Keeping up on the results of food safety tests is a given — but due to the FDA’s Food Safety Modernization Act, food producers also need to be able to trace the ingredients and materials that go into their products.

When you’re tracking foods and ingredients with barcodes or other unique identifiers, this is called traceability. When you’re tracking raw ingredients that are harder to keep tabs on, it’s called material flow analytics. In either case, you should be collecting and analyzing data on your products as they make their way through the food chain. When and how are the vegetables harvested? What are the conditions in storage? When are they transported, and what are the cleaning methods and schedules for the containers they’re transported in?

Tracking this data does more than improve safety — it can also help attract new customers and build customer loyalty. Survey data shows that consumers started worrying more about food safety when the COVID-19 pandemic began. Being able to show customers where your ingredients come from, the journey your product takes from the farm to the store, and the data on your safety measures can reassure them that you have their health top of mind.

Inventory data

Sales data is an important part of the picture for operational planning. But if you don’t know how much inventory is sitting at the distributor or on the retail shelves — the SKU, the number of units, and the expiration date for all those items — you’re missing critical inputs that can help unlock greater profitability for your business. Let’s start with inventory that is running low. This is a heads up for you to proactively reach out to a buyer to see if they’d like to place another order. You can also adjust your production schedule to keep up with an anticipated order and avoid short shipping.

On the flip side, if inventory levels are too high, you may end up with wasted product and higher deductions. Keeping an eye on potential deductions is critical for maintaining profitability – and you don’t want to wait to for a statement from your retail partners to start thinking about this. Additionally, high inventory levels can be an indication that too much of your cash flow is tied up in inventory. You may want to stay leaner and spend those resources elsewhere, like marketing. Finally, you want to think about critical mass. Are you shipping small quantities of inventory to various locations that are driving up your transportation costs? If so, you may want to look at how that affects profitability and course-correct.

To analyze data, you need to have data

Why do many small and medium-sized food companies rely so heavily on POS? Why don’t they track every bit of data that might help them improve their businesses? It all comes down to availability and accessibility of data.

Some data is just too expensive to fit the budgets of smaller food producers. Data analytics and market research companies charge a heavy premium for this information, and some categories of data are difficult to find elsewhere. For example, says Koretz, “Inventory is generally a very difficult piece of information to get from any distributor or retailer.”

Large retailers may be hesitant to share data because they don’t want competitors to get their hands on the company’s proprietary information. And even though you can access the data from some big retailers like Amazon and Target, you need to understand how to operate their systems and have the data analytics skills to effectively use the information. Otherwise you have to resign yourself to using the generic reports from these companies, which aren’t as comprehensive or useful as what you can get by going into the systems yourself. Furthermore, the process of logging in, downloading reports, and manipulating data on, say, 10 different spreadsheets is tedious and time consuming — which is a serious concern if you’re a small team that’s already spread thin.

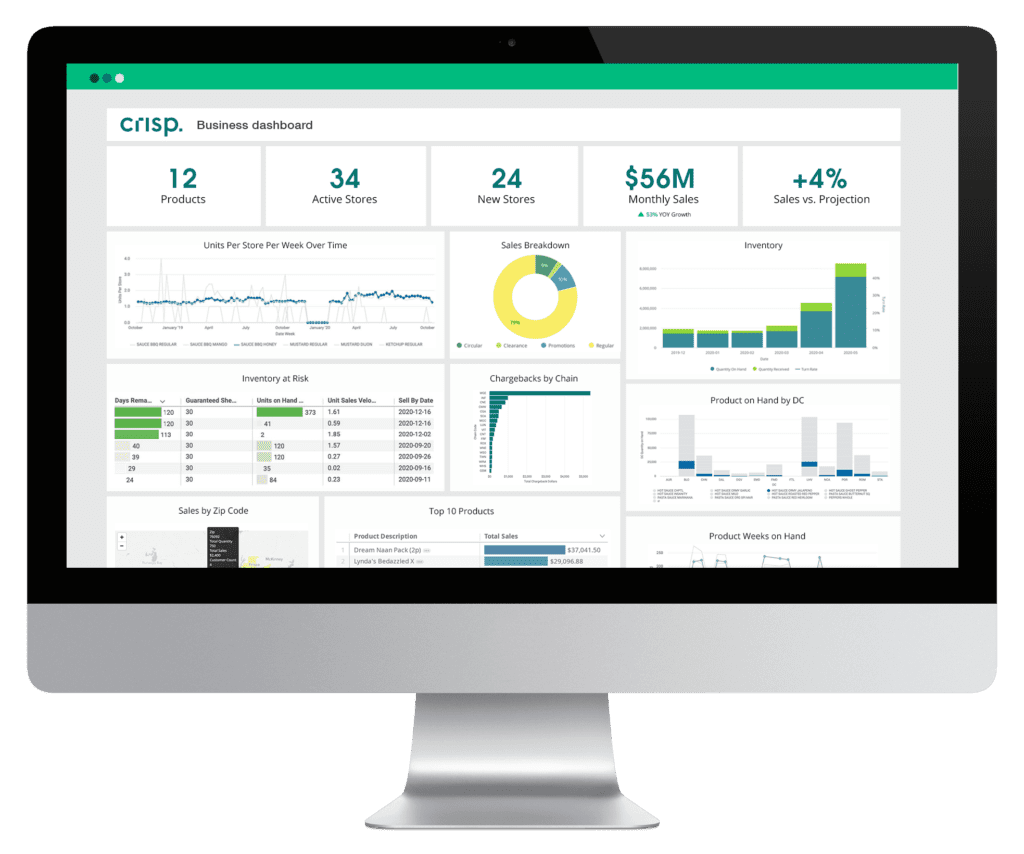

To help solve this problem, software companies are creating products that not only help food producers collect and analyze data, but also enable partners across the food chain to share data with one another. This means small and medium-sized food companies are finally able to take advantage of data that used to be too expensive or too complex for the average producer — so they can combine those all-important POS numbers with all the right data to help them thrive.

Crisp connects and analyzes disparate data sources in real time, providing food brands with meaningful insights and trends to manage their business. Contact us today for a demo of our business insights dashboard.