How to spot voids and take action

It’s often said that “the best offense is a good defense.” It turns out, this theory applies perfectly to retail sales. CPG brands often focus on gaining new retail customers — and while it is important to gain distribution (offense), what can really make or break a CPG business is how you retain those stores and ensure they’re performing (defense). Here, we'll outline how brands can use data to do just that.

Retail Voids 101

So why do you need a good defense exactly? The answer is voids: a common threat that can easily eat away at your hard-won distribution wins. Voids can be defined as any situation in which a retailer has agreed to sell your product, but for some reason, the product is not actually selling at the store. This can happen for a variety of reasons (which makes voids particularly hard to detect or deal with — but we’ll get to that in a minute). Possible scenarios might include:

- Product placement: Customers often move products around while shopping, which can cause yours to become hidden behind another brand. This obviously impacts sales, but it also prevents re-ordering by the store if your product is no longer visible to employees taking inventory.

- Missing shelf tags: Shelf tags can too easily be knocked off the shelf. This prevents re-ordering because it interferes with inventory processes that rely on scanning those tags.

- Problems with inventory: Aside from physical disruptions, there can be systematic problems with restocking. Perhaps a bug in an automatic ordering system or simple human error leads to a retailer thinking there’s still plenty of product in stock, but there actually isn’t.

- Out of stock situations: Out of stocks are a bit different from traditional voids, but they can lead to voids in the future. Perhaps when a retailer didn’t have your product on hand, they filled the shelf with another item and forgot to replenish yours.

While voids can occur at retail stores thousands of miles away, it’s ultimately up to brands to detect them as quickly as possible and follow up with brokers, buyers, or DSD reps to remedy the situation.

Voids are a common threat that can easily eat away at your hard-won distribution wins. Voids can be defined as any situation in which a retailer has agreed to sell your product, but for some reason, the product is not actually selling at the store.

Why voids matter to emerging brands

Getting a handle on voids is especially important for challenger brands looking to gain and maintain market share, for a few different reasons. As a relatively small player, you are less likely to be top of mind for retailers, and therefore need to put in extra effort to get any issues resolved in-store. And when you have less shelf space than larger brands, it’s easier for things to physically interfere with that space and cause voids. Voids are also particularly common among independent retailers in natural channels, because these stores often lack automatic ordering systems and are therefore prone to human error. It’s more likely that ordering falls to one department manager, who is probably very busy and doesn’t have a system that would automatically notify her to order more of your product. Finally, natural grocers have a lot more variety, which means more products to keep track of (if you’ve ever browsed the vitamin aisle at a bustling natural foods store, you know what I mean). For brands working with these retailers, the ability to proactively reach out about potential voids can pay off in a big way.

The problem is, emerging brands don’t have full analyst teams poring through massive pivot tables of sales and distribution data to identify possible voids. They might not have an analyst at all. That’s why at Crisp, we’ve built a Voids Dashboard and an automated alert system to help sales teams find possible voids, investigate, and take action.

Detecting voids with data

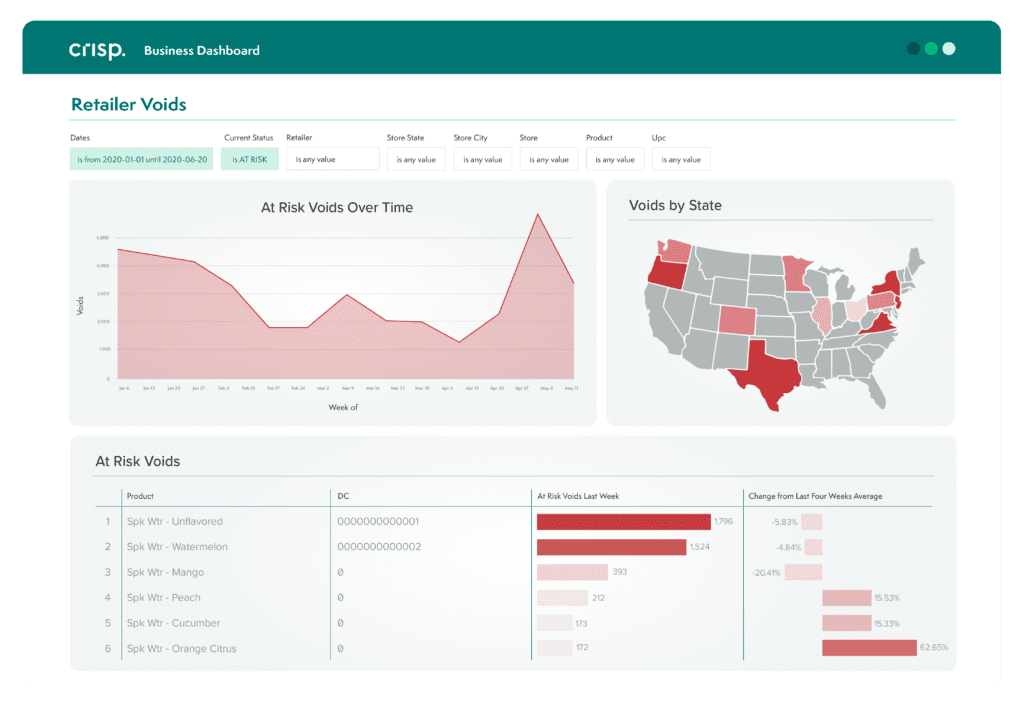

Crisp’s Voids Dashboard uses a proprietary machine learning model to automatically detect stores where your product should be selling, but isn’t. Crisp references 13 different data points including current and historical sales data from multiple nearby stores and products, along with additional geography and retailer-specific data points, to make predictions. From there, Crisp will notify you of possible voids, surfacing them in the Voids Dashboard. Through the Dashboard, you can:

- View the product-store combinations that represent possible voids across retail locations

- Drill down by product with UPCs geographically, or by banner

- Easily export a filtered list of stores and products to send to your broker or merchandising team to resolve any detected issues

Here’s an example of how brands can use the Voids Dashboard in practice: You might start by getting an email notification from Crisp about possible voids. To check them out, you click the link in the email to see your Voids dashboard. Once there, you filter down to a particular SKU and retailer. Now you can see that there are certain locations in California where sales have unexpectedly dropped: while these products usually sell several units per store per week, scan data shows it’s been 6 weeks since there have been any sales. Clearly, something is going on at those stores — perhaps there’s been an issue with the shelf there. Next, you export the store list to follow up with your sales rep, broker, or buyer.

At the end of the day, the key is to detect voids quickly, easily investigate the cause, and take action. Ultimately, this can mean the difference between losing valuable sales and defending your distribution to retain sales. The team at Outstanding Foods has done this well, using the Voids Dashboard to manage their broker team as they expand to an increasingly wide range of national retailers. As COO Bobbie Turco says, “In this industry, there are multiple different touch points on every sale, and you’re only as good as the information you have.”

Get insights from your retail data

Crisp connects, normalizes, and analyzes disparate retail data sources, providing CPG brands with up-to-date, actionable insights to grow their business.